Cadre Vantage: Quarterly Insights (Q2 2023)

In our most recent quarterly letter to investors, we explain how we look forward to seizing value investing opportunities generated by market dislocations in the coming months.

Executive Summary

- The market is pricing in continued high interest rates, which, along with increased operating expenses and slower growth, may make it difficult for some asset owners to generate positive cash flow.

- With $1.5 trillion of commercial real estate debt coming due through 2025, we expect to see forced sales as well as some defaults in specific property types. However, we do not anticipate widespread distress in commercial real estate.

- Dislocations between asset prices and long-term intrinsic value are ripe with possibility and opportunity for value investors like Cadre.

The Cadre team is looking forward to benefiting from value investing opportunities in the coming months. With trillions of dollars[1] worth of commercial real estate loans coming due by the end of 2025 and historically high interest rates, we anticipate being able to seize on mispricings. Historically, market dislocations like we are seeing today have resulted in unique opportunities to generate outsized investment returns.

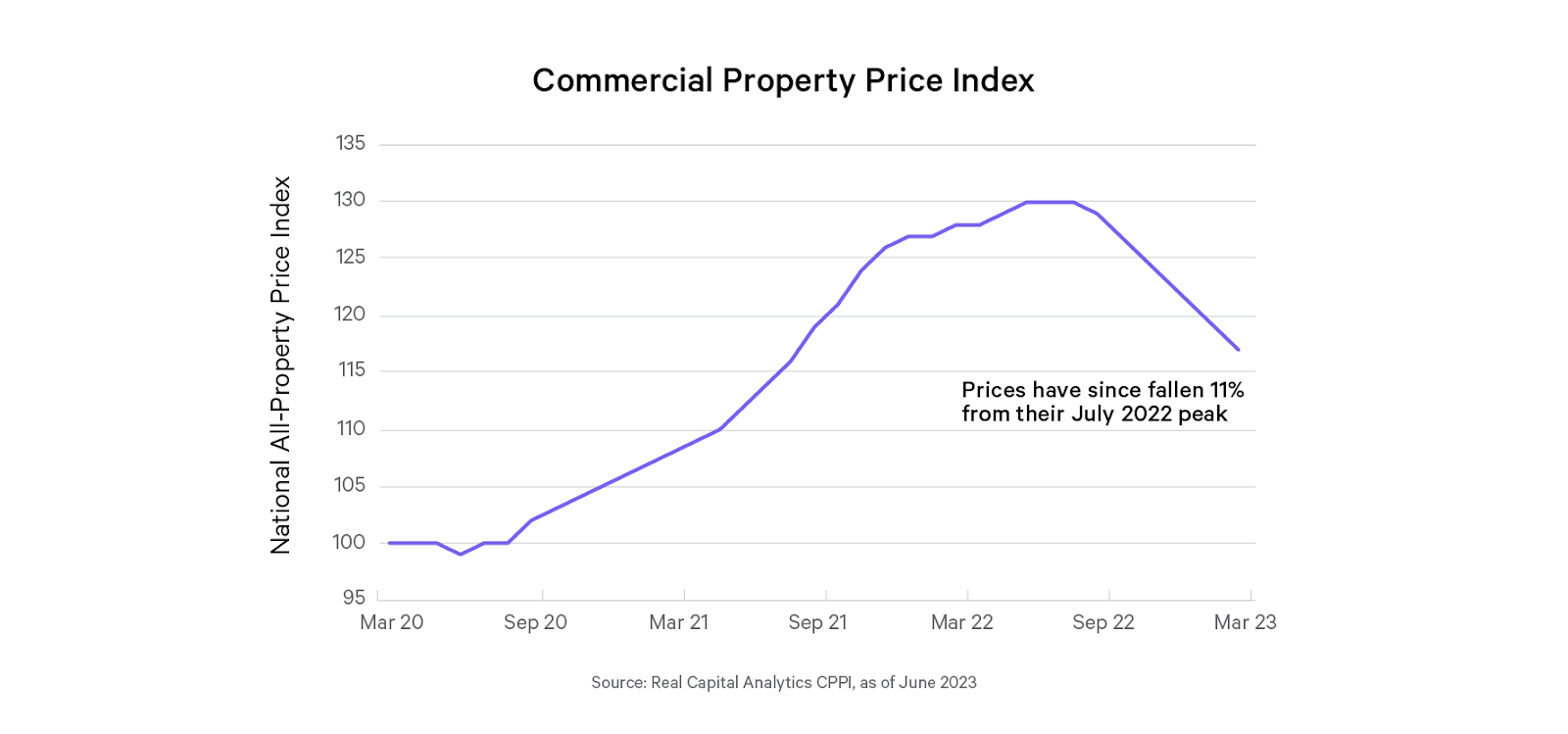

Rising interest rates have led to material price dislocations in other investment products, including stocks, bonds, venture capital, private equity, and crypto. In commercial real estate, assets are repricing, too. We expect to see distress in specific property types, but we do not anticipate this to be widespread.

In general, we have noted:

- Cap rates have increased approximately 150-200 bps.

- Prices are moderating across property types.

- There is less liquidity.

This could be a great opportunity for investors as we seek new acquisitions for CDAF II.

Today’s dislocations are affecting real estate asset classes and markets in disparate ways. We expect fundamentals to hold up in multifamily and industrial. We also believe there will soon be opportunities to acquire institutional-quality assets at discounts to their intrinsic value. This chance could be right around the corner—and may not come around again for some time.

Some owners, particularly of capital-intensive property types such as offices, will struggle to generate positive cash flow. The combination of interest rate increases and secular shifts in work culture may lead to an office owner’s inability to pay debt service or secure new financing, potentially forcing them to sell. Forced sales may also occur in order for fund managers to cover redemption requests. We are already seeing large redemptions in a few of the largest open-ended fund vehicles.

Cadre’s Investments team is being extremely prudent in the current market environment. We are prepared to invest in compelling opportunities and intend to unlock access to these opportunities for both institutional and individual investors when they become available. To that end, we recently launched the second fund in our Direct Access series, Cadre Direct Access Fund II (CDAF II), to take advantage of value investing opportunities.

Where we believe we can capture value

The chart below shows commercial real estate debt by asset class coming due this year. Floating rate loans are commonly used in the real estate industry, which are affected greatly by interest rate increases. Owners may be unable to pay debt service, or they may not be able to refinance, which could lead to their simply handing back the keys.

In some cases, owners of investments with maturing debt may choose to exit the investment rather than call new capital, while their operating partner may want to remain in the deal. Experienced sponsors in Cadre’s network may provide us with these types of recapitalization opportunities, where we can step into the deal with fresh equity alongside them. These recapitalization opportunities allow Cadre to enter the investment typically at off-market pricing and to partner with a sponsor who has experience with the asset and believes there is value yet to be extracted from the investment.

As the chart above shows, the largest amount of debt is set to mature in office assets. We believe that discounts in office values could present some interesting buying opportunities. The second largest opportunity, ranked by debt maturity, could very well be found in multifamily, one of Cadre’s specialties and the majority of our existing portfolio.

Since the opportunities to benefit from mispricings are extremely asset-specific, we believe it is more important than ever for investors to choose the right investment manager. Cadre takes a single-asset approach to sourcing and diligence. Before we invest in a single deal and bring it to our platform, Cadre’s Investments team spends hundreds of hours on diligence for each transaction we close. Our points of review include cash flow modeling, market and submarket research, site visits, legal structuring, and capital and environmental reviews. We close on only ~2% of all investment opportunities we review.

Our Investments team also manages each asset across the entire investment lifecycle—an aspect of our process that can also be incredibly valuable in the current economic cycle. (We present a case study of hospitality asset management later on to pull the curtain back on how Cadre’s very active process earned profits for our investors).

Cadre has the patience and flexibility within our mandate to wait for specific, discounted assets to invest in. We look forward to bringing the most valuable deals we can find in this economic cycle to Cadre members.

More investors are considering commercial real estate

High inflation and high interest rates are contributing to U.S. investors’ large appetite for non-traditional investing opportunities. The results of Cadre’s recent poll of 1,000 investors surveyed by OnePoll found that more than half are excited about commercial real estate’s potential for steady income (52%) and inflation protection (50%).

Additional benefits of adding private commercial real estate to a larger portfolio include:

- Diversification[2] to help protect against the volatility found in traditional investments like stocks and bonds.

- The potential to produce compelling long-term returns.

- Historical hedge against inflation.

Surprising discoveries from our recent survey also include:

- Over three-fourths (77%) of investors surveyed believe it is not only important to save for retirement but also to pass on wealth to their families.

- More than half (53%) of those invested in commercial real estate are very confident that their current strategy will help them reach their wealth goals, while only 19% of those not invested in commercial real estate were able to say the same.

You can learn more about our survey and its results here.

Cadre Updates

Last Asset Added to Cadre Direct Access Fund (CDAF I) - Fund is Now Fully Invested

We’re thrilled to announce that our first Direct Access fund, CDAF I, is now fully invested!

In Q2 we acquired Indigo at Cross Creek, a 303-unit multifamily asset in Charlotte, North Carolina. Charlotte has been among the nation’s fastest growing markets for both population and new jobs, driving multifamily performance. The asset’s affluent submarket is close to one of the city’s premier suburban office nodes and has an excellent public school system. Our team secured this investment off-market with a fixed interest rate loan that allows for immediate positive leverage.

Leveling the Playing Field

Seven years running! Cadre earned a top slot in the annual Forbes Fintech 50[3]for the seventh time this spring. We were included on their annual list of “the most innovative private fintech companies” for Cadre’s recent fund launches, including CDAF II and Cadre Horizon Fund. We are extremely proud of our repeat status and the recognition among our peers.

In June, Cadre Founder & CEO Ryan Williams appeared on Bloomberg TV’s “The Close” to discuss the state of commercial real estate markets and where investors can look to find compelling investment opportunities in today's environment. “You can always find a good micro opportunity, even in a bad macro environment … the days of thematic investing in commercial real estate, in our view, are over,” Ryan told Bloomberg TV.

Ryan also appeared on CNBC’s Closing Bell in May to share his outlook on investment opportunities in commercial real estate. He shared what some managers are doing today to fully capitalize on attractively priced assets over the coming months and years, citing market stress that is expected to drive property sales. Ryan’s full appearance on CNBC is available to view here.

Ryan joined Yahoo Finance to discuss the results of our recent survey conducted by OnePoll. In this segment, Ryan explained why he thinks the 1,000 investors surveyed expressed their continued interest in commercial real estate and where they might uncover opportunities in the months to come. The NY Post also reported on this survey, which provided some important data about the level of confidence investors have in their ability to generate sustainable wealth.

To learn more about our views on commercial real estate, and what’s new at Cadre, sign up for free to read our full Quarterly Investor letter, available only to Cadre members.

- Denkanikotte, Vivek. “CRE Bank Performance: Answering Questions Surrounding Lending & Debt.” Trip, 18 May 2023.https://www.trepp.com/trepptalk/cre-bank-performance-answering-questions-surrounding-lending-debt ↩︎

- Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.↩︎

- Kauflin, Jeff and Novack, Janet. “The FinTEch 50. Forbes, 06 June 2023. https://www.forbes.com/lists/fintech50/?sh=76895eca18d3. ↩︎

Disclaimer

Educational Communication

Not AdviceThe views expressed above are presented only for educational and informational purposes and are subject to change in the future. No specific securities or services are being promoted or offered herein.

Not Advice

This communication is not to be construed as investment, tax, or legal advice in relation to the relevant subject matter; investors must seek their own legal or other professional advice.

Performance Not Guaranteed

Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are not guaranteed and may not reflect actual future performance.

Risk of Loss

All securities involve a high degree of risk and may result in partial or total loss of your investment.

Liquidity Not Guaranteed

Investments offered by Cadre are illiquid and there is never any guarantee that you will be able to exit your investments on the Secondary Market or at what price an exit (if any) will be achieved.

Not a Public Exchange

The Cadre Secondary Market is NOT a stock exchange or public securities exchange, there is no guarantee of liquidity and no guarantee that the Cadre Secondary Market will continue to operate or remain available to investors.

Opportunity Zones Disclosure

Any discussion regarding “Opportunity Zones” — including the viability of recycling proceeds from a sale or buyout — is based on advice received regarding the interpretation of provisions of the Tax Cut and Jobs Act of 2017 (the “Jobs Act”) and relevant guidances, including, among other things, two sets of proposed regulations and the final regulations issued by the IRS and Treasury Department in December of 2019. A number of unanswered questions still exist and various uncertainties remain as to the interpretation of the Jobs Act and the rules related to Opportunity Zones investments. We cannot predict what impact, if any, additional guidance, including future legislation, administrative rulings, or court decisions will have and there is risk that any investment marketed as an Opportunity Zone investment will not qualify for, and investors will not realize the benefits they expect from, an Opportunity Zone investment. We also cannot guarantee any specific benefit or outcome of any investment made in reliance upon the above.

Cadre makes no representations, express or implied, regarding the accuracy or completeness of this information, and the reader accepts all risks in relying on the above information for any purpose whatsoever. Any actual transactions described herein are for illustrative purposes only and, unless otherwise stated in the presentation, are presented as of underwriting and may not be indicative of actual performance. Transactions presented may have been selected based on a number of factors such as asset type, geography, or transaction date, among others. Certain information presented or relied upon in this presentation may have been obtained from third-party sources believed to be reliable, however, we do not guarantee the accuracy, completeness or fairness of the information presented.

No U.S. or foreign securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided by or through us.

.svg)

.svg)

.svg)

.svg)

.png)